Driver monitoring system helps provide on demand insurance

Traditional commercial activity has been based on the purchase model. Customers buy a physical product and then own it, as in the case of books. Otherwise, customers have paid for services as needed. A newer model is the subscription concept. Users pay regular licence fees for continual use of virtual products that they do not own. Examples lately include television streaming services and certain software applications. The EU funded FAIR project helped the automotive insurance industry move into the subscription paradigm. The new approach allows insurers to tailor cover to customer requirements, leading to lower prices and greater flexibility. Insurers will also be better able to manage claims.

Behaviour monitoring

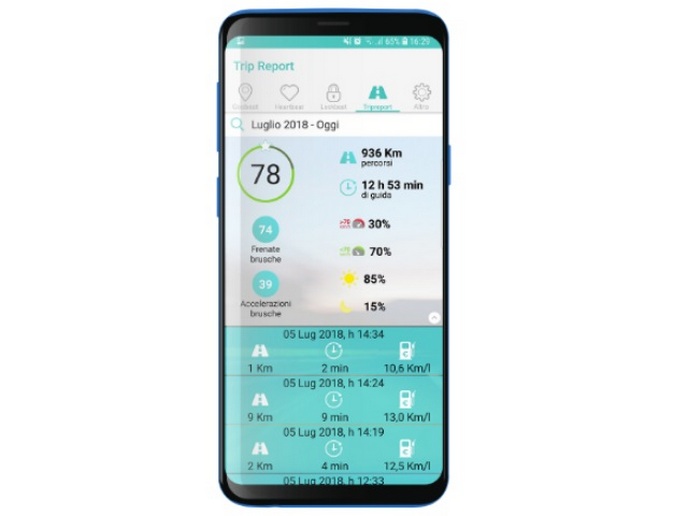

The core of this concept is a new technical system, developed by FAIR, that monitors driver behaviour to assess risk. Researchers focused on developing a set of indicators for interpreting that. The team also created an Internet of Things, IoT platform consisting of various telemetry and data management software layers. The system’s purpose is to allow insurers to offer a monthly instalment option that varies depending on car usage. The system in part evaluates usage according to distance driven; thus, during periods of low usage, users pay less. Key to this assessment is cars able to connect to the IoT using a standard mobile communications device, such as smartphone or tablet. “The system collects information about movement, type of roads and driving times of day,” says Igor Valandro, FAIR coordinator. “From that, it works out distances driven, also specific driving parameters, such as speed, plus style of braking, acceleration and cornering,” adds Valandro.

Risk assessment

A machine learning algorithm groups drivers having the same driving styles and frequency patterns into high and low risk groups. High risk means high intensity and high driving frequency. Low risk is the opposite. The system also monitors the driver over a period of time to get an averaged view, since driving style can vary depending on the weather and other factors. From this information, the system determines risk level and sets a premium accordingly. The system reports its assessment to drivers in the form of coaching tips. These enhance driver skills and reinforce low risk behaviour. Researchers addressed community concerns about personal data collection. Users have complete access to all data coming from their vehicles. “Each customer will be fully informed about the processing of the data and will be able to give consent,” explains Valandro. “Furthermore, data collected will be limited to this specific use and will be unavailable for other purposes.” The new insurance paradigm will be offered to individuals, fleet customers and car dealers. Fleet customers will be able to monitor the usage history of all vehicles to improve efficiency and security, while also reducing costs. Car dealerships will be able to monitor the condition of all vehicles to minimise the risk of breakdown and to more effectively provide roadside assistance. The team continues to refine the behavioural algorithms and the system’s core functional technologies. The next stage of development will migrate the system away from the reliance on third party devices and towards native devices fitted to cars.

Keywords

FAIR, insurance, subscription, monitoring, driver behaviour, automotive, risk assessment